Contents:

HealthEquity, Inc. provides range of solutions for managing health care accounts. The firm’s offers its solutions for employers, health plans, brokers, consultants and financial advisors. Its services include HAS, FSA, HRA, DCRA, 401, Commuter, COBRA and HIA. It also offers products like healthcare saving and spending platform, health savings accounts, investment advisory services, reimbursement arrangements, and healthcare incentives.

Let’s start up with the current stock price of HealthEquity Inc. , which is $52.44 to be very precise. The Stock rose vividly during the last session to $59.74 after opening rate of $58.60 while the lowest price it went was recorded $52.27 before closing at $61.68. Zacks Earnings ESP looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season.

Healthequity Inc HQY:NASDAQ

Provide specific products and services to you, such as portfolio management or data aggregation. Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. HQY typically sells its solutions to employers, who then offer them to their employees. The company also manages other common employee benefits that complement its HSA offerings.

HealthEquity’s stock was trading at $61.64 at the start of the year. Since then, HQY shares have decreased by 4.7% and is now trading at $58.75. Investchronicle.com is an Economic news website, which offers broad information about the Stock markets and Equities. The major emphasis of this platform is to present, the most practical recommendation for public and private capital sharing, both in the form of updates and detailed analysis.

The consensus among Wall Street equities research analysts is that investors should “buy” HQY shares. High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More https://day-trading.info/ value-oriented stocks tend to represent financial services, utilities, and energy stocks. We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions.

Services

Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. We’d like to share more about how we work and what drives our day-to-day business. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

For HealthEquity, the consensus EPS estimate for the quarter has remained unchanged over the last 30 days. And a stock’s price usually doesn’t keep moving higher in the absence of any trend in earnings estimate revisions. So, make sure to keep an eye on HQY going forward to see if this recent jump can turn into more strength down the road.

The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities. For Natera , the consensus EPS estimate for the upcoming report has changed +5.8% over the past month to -$1.17.

Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time. Verify your identity, personalize the content you receive, or create and administer your account. Paris covers the Services sector, focusing on stocks such as Grand Canyon Education, H&R Block, and Universal Technical Institute. I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Analyst Ratings

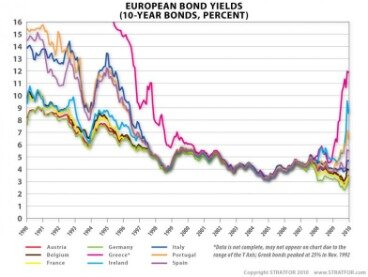

HealthEquity does not have a long track record of dividend growth. Upgrade bond world is backing away from all that negativity as 2019 ends to MarketBeat Daily Premium to add more stocks to your watchlist.

HealthEquity, Inc. Common Stock (HQY) Stock Price, Quote, News & … – Nasdaq

HealthEquity, Inc. Common Stock (HQY) Stock Price, Quote, News & ….

Posted: Sat, 14 Sep 2019 10:39:08 GMT [source]

It serves clients through a direct sales force; benefits brokers and advisors; and a network of health plans, benefits administrators, benefits brokers and consultants, and retirement plan record-keepers. The company was incorporated in 2002 and is headquartered in Draper, Utah. Market Cap is calculated by multiplying the number of shares outstanding by the stock’s price. To calculate, start with total shares outstanding and subtract the number of restricted shares. Restricted stock typically is that issued to company insiders with limits on when it may be traded.Dividend YieldA company’s dividend expressed as a percentage of its current stock price. HealthEquity Inc provides solutions that allow consumers to make healthcare saving and spending decisions.

There really aren’t any good comps to value HQY off of, now that it purchased WageWorks. Historically, the company has commanded a healthy EV/EBITDA multiple, often over 40x. When it reported its Q3 results in December, HQY not only increased its FY23 forecast for the 4th straight quarter, in an unusual move it also provided FY24 guidance. When looking at risks, a drop in interest rates would be negative. That said, this is a company that had become accustomed to a low rate environment that is suddenly seeing a nice benefit.

HealthEquity Reports Record HSA Sales, Asset Growth

Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. 10 Wall Street equities research analysts have issued “buy,” “hold,” and “sell” ratings for HealthEquity in the last year. There are currently 2 hold ratings and 8 buy ratings for the stock.

Brokerages have given HealthEquity, Inc. (NASDAQ:HQY) an … – Best Stocks

Brokerages have given HealthEquity, Inc. (NASDAQ:HQY) an ….

Posted: Tue, 24 Jan 2023 08:00:00 GMT [source]

69.0% of employees surveyed would recommend working at HealthEquity to a friend. HealthEquity has a short interest ratio (“days to cover”) of 3.9, which is generally considered an acceptable ratio of short interest to trading volume. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. Researching stocks has never been so easy or insightful as with the ZER Analyst and Snapshot reports. HealthEquity witnesses solid growth in HSAs, besides recording robust performances in majority of its segments, in the second quarter of fiscal 2023.

Mobile payments are projected to boom into a massive $12 trillion market by 2028. According to Motley Fool this growth stock could “deliver huge returns.” Not only in the immediate future but also over the next decade. Especially since the man behind this company is a serial entrepreneur who has been wildly successful over the years. The mean of analysts’ price targets for HealthEquity points to a 29.9% upside in the stock.

This means that over the past quarter there has been an increase of insiders selling their shares of HQY in relation to earlier this year. I think HQY stock can ride the interest rate tailwind higher, and don’t think a $100 stock price is out of the question. That would be about a 22.5x multiple on the current FY25 EBITDA consensus.

- Zacks Earnings ESP looks to find companies that have recently seen positive earnings estimate revision activity.

- More value-oriented stocks tend to represent financial services, utilities, and energy stocks.

- HSA savings are tax exempt, as is the interest or earnings they generate, and any distribution for qualified medical reasons are tax free as well.

- It also provides mutual fund investment platform; and online-only automated investment advisory services through …

According to analysts’ consensus price target of $80.62, HealthEquity has a forecasted upside of 36.6% from its current price of $59.00. Raw Stochastic average of HealthEquity Inc. in the period of last 50 days is set at 1.03%. The result represents improvement in oppose to Raw Stochastic average for the period of the last 20 days, recording 1.03%. In the last 20 days, the company’s Stochastic %K was 30.05% and its Stochastic %D was recorded 55.79%.

The company was founded by Stephen D. Neeleman on September 18, 2002 and is headquartered in Draper, UT. The firm’s offers its solutions for employers, health planbs, brokers, consultants and financial advisors. The firm’s offers its solutions for employers, health plans, brokers, consultants and financial advisors. HealthEquity, Inc. provides technology-enabled services platforms to consumers and employers in the United States. It also provides mutual fund investment platform; and online-only automated investment advisory services through Advisor, a Web-based tool.

Year-to-date Price performance of the company’s stock appears to be encouraging, given the fact the metric is recording -14.93%. Additionally, trading for the stock in the period of the last six months notably deteriorated by -21.66%, alongside a downfall of -2.29% for the period of the last 12 months. The shares increased approximately by -20.55% in the 7-day charts and went down by -13.08% in the period of the last 30 days. Common stock shares were lifted by -18.89% during last recorded quarter. Market capitalization is calculated by taking a company’s share price and multiplying it by the total number of shares. In the Morningstar Style Box, large-cap names account for the largest 70% of U.S. stocks, mid-cap names account for the largest 70–90%, and small-cap names are the remaining 10% of companies.

Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated. Of the $22 billion in assets that HQY holds for customers, over $14 billion is in cash.

HealthEquity stock price target raised to $85 from $76 at BofA Securities

To see all exchange delays and terms of use please see Barchart’s disclaimer. One share of HQY stock can currently be purchased for approximately $58.75. HealthEquity’s stock is owned by a variety of institutional and retail investors. Sign-up to receive the latest news and ratings for HealthEquity and its competitors with MarketBeat’s FREE daily newsletter. The P/E ratio of HealthEquity is -84.29, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings.