Contents:

We do not use the balance for retained earnings from the adjusted trial balance because it is the beginning balance for the period. MM TAX did not have a beginning balance for retained earnings because it is a new company started in December. We also do not use the balance for dividends from the adjusted trial balance because dividends do not appear on the balance sheet; they are closed to retained earnings prior to completing the balance sheet. In a classified balance sheet, financial information is presented in detail. The components of assets, liabilities, and equity are broken down into further sub-headings for provided in-depth information to the users.

ECB publishes supervisory banking statistics for the fourth quarter of … – ECB Banking Supervision

ECB publishes supervisory banking statistics for the fourth quarter of ….

Posted: Wed, 12 Apr 2023 08:04:05 GMT [source]

The category forensic accounting defineds 12 months of principal on notes payable; your accounts, salaries and interest payables; accrued liabilities; client retainers or deposits; and unearned revenue. You might also need contra accounts for your current liabilities, such as for discounts on your notes payable. Limited Brands’ current ratio averaged 2.1 for its fiscal years 2006 through 2010. The current ratio for each of these years suggests that the company’s short-term obligations can be covered with its short-term assets. However, if its ratio would approach 1.0, Limited would expect to face challenges in covering liabilities.

Household Budget Template

An unclassified balance sheet reports your assets and liabilities, but does not separate the items into classes. The total values of your assets and debt equal the same amount, regardless of whether your balance sheet is classified or unclassified. An unclassified sheet is simpler to produce, but may warrant additional questions from investors or outside parties about the character of your net worth or liquidity position. A business that has very few lines items to report will typically choose to use an unclassified balance sheet, such as a very small business or a shell company.

Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent. If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

Non-current Assets

Closing ProcessThe closing process is identical under U.S. Although unique accounts can arise under either system, the closing process remains the same. Sales taxes payable are the taxes a company has collected from customers but not yet remitted to the taxing authority, usually the state. Office equipment includes computers, copiers, FAX machines, and phone answering machines.

- However, if its ratio would approach 1.0, Limited would expect to face challenges in covering liabilities.

- An unclassified sheet is simpler to produce, but may warrant additional questions from investors or outside parties about the character of your net worth or liquidity position.

- If you operate a partnership, the category would list each partner’s equity.

If significant, these nontrade receivables are usually listed in separate categories on the balance sheet because each type of nontrade receivable has distinct risk factors and liquidity characteristics. See below for the balance sheet reporting treatment of the current and long-term liability portions of the Note Payable from initiation to final payment. The balance sheet is a summary of the financial balances of a company and reflects the company’s solvency and financial position. The owner/officer debt section simply includes the loans from the shareholders, partners, or officers of the company. This section gives investors and creditors information about the source of debt and more importantly an insight into the financing of the company. For instance, if there is a large shareholder loan on the books, it could mean the company can’t fund its operations with profits and it can’t qualify for a commercial loan.

Together they help reveal a company’s short-term debt-paying ability. Intangible assets Intangible assets consist of the noncurrent, nonmonetary, nonphysical assets of a business. Companies must charge the costs of intangible assets to expense over the period benefited.

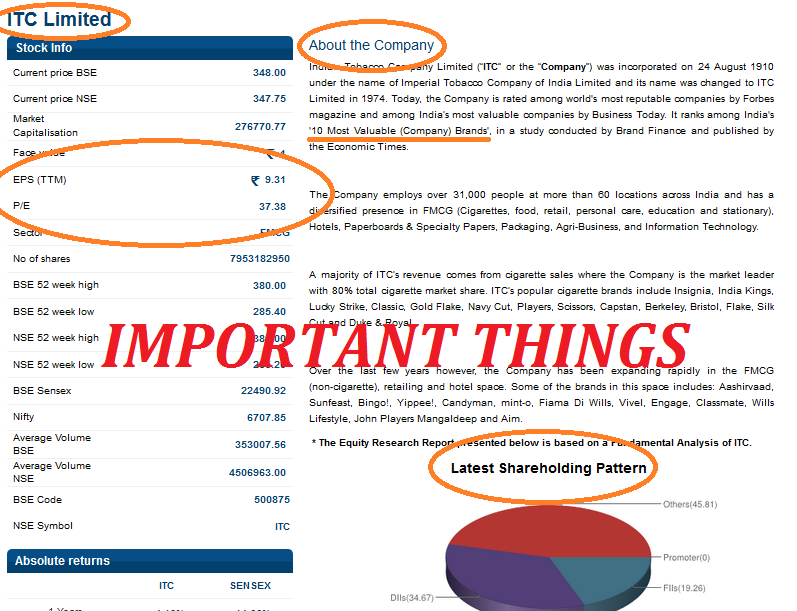

Our work has been directly cited by organizations including MarketWatch, Bloomberg, Axios, TechCrunch, Forbes, NerdWallet, GreenBiz, Reuters, and many others. Carbon Collective is the first online investment advisor 100% focused on solving climate change. We believe that sustainable investing is not just an important climate solution, but a smart way to invest. Some assets are valued at historical or book value, like land and machinery, and some have a more complex way of calculating, like goodwill and brand name. The Motley Fool has no position in any of the stocks mentioned.

Business Case Studies

For example, understanding which assets are current assets and which are fixed assets is important in understanding the net working capital of a company. In the scenario of a company in a high-risk industry, understanding which assets are tangible and intangible helps to assess its solvency and risk. If assets are classified based on their convertibility into cash, assets are classified as either current assets or fixed assets.

Cumulative translation adjustments result from translating foreign currencies into US dollars . The unrealized loss on investments is discussed in Chapter 14. The company seems to be strapped for cash because the vast majority of its substantial holdings are in non-liquid assets, specifically patents and subsidiary company stock.

A classified balance sheet is a financial statement that reports the assets, liabilities, and equity of a company. It breaks each account into smaller sub-categories to provide more value for the user of this report. The classified balance sheet makes sure that all these calculations are properly communicated to the reader. Although there are no set rules for these classifications as an implicit industry practice, most businesses prefer reporting assets and liabilities based on a time horizon. The assets, liabilities, and owner’s equity account names and balances from MM TAX’s adjusted trial balance are shown below.

Interest payable is interest that the company has accumulated on notes or bonds but has not paid by the balance sheet date because it is not due until later. Notes payable are unconditional written promises by the company to pay a specific sum of money at a certain future date. The notes may arise from borrowing money from a bank, from the purchase of assets, or from the giving of a note in settlement of an account payable. Generally, only notes payable due in one year or less are included as current liabilities. Traditional balance sheets only list down the assets, liabilities, and equity without any classification or breakdowns.

MM TAX: Classified Balance Sheet

In other words, equity is the difference between assets and liability. The format of the classified balance sheet ‘s liabilities side can be divided into three main categories. It is determined by subtracting the fair value of the company’s net identifiable assets from the total purchase price. Operating Cycle Of The BusinessThe operating cycle of a company, also known as the cash cycle, is an activity ratio that measures the average time required to convert the company’s inventories into cash.

US ENERGY CORP Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-K) – Marketscreener.com

US ENERGY CORP Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-K).

Posted: Thu, 13 Apr 2023 20:34:08 GMT [source]

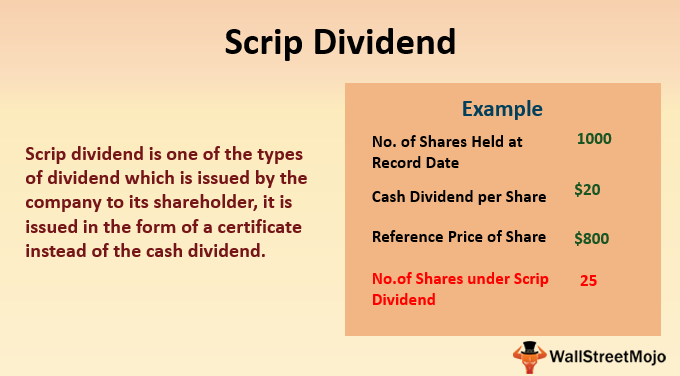

Maturity dates should appear on the balance sheet for all major long-term liabilities. Dividends payable, or amounts the company has declared payable to stockholders, represent a distribution of income. Since the corporation has not paid these declared dividends by the balance sheet date, they are a liability.

classified balance sheet

This inhttps://1investing.in/ion is important to any potential investor or creditor. Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser. Additional Paid-in CapitalAdditional paid-in capital or capital surplus is the company’s excess amount received over and above the par value of shares from the investors during an IPO.

However, overall, current asset items are still relatively more liquid in nature than fixed assets or intangible assets. Business owners should draft up unclassified balance sheets to state their current assets, liabilities, and shareholder equities– and use this document to gauge performance and business standings. Laying out all of these financial reports in an unclassified balance sheet will relieve you of the stress of trying to collect all of the information from different sources. You can use a balance sheet template to consistently input liabilities and assets, so they’re all in one financial statement for that accounting period. This means most companies use a one-year period in deciding which assets and liabilities are current.

It also affects decisions by creditors when lending money to a company, including loan terms such as interest rate, due date, and collateral requirements. It can also affect a manager’s decisions about using cash to pay debts when they come due. The current ratioRatio used to evaluate a company’s ability to pay its short-term obligations, calculated by dividing current assets by current liabilities.

Let’s walk through each one of these sections and answer the question what is a classified balance sheet. Prepare the statement – Finally, the statement must be created, and the accounting equation must be balanced to ensure accuracy. A classified balance sheet also provides a clear and crisp view to the user.

For an IT service industry, fixed assets will be desktops, laptops, land, etc., but it can be machinery and equipment for a manufacturing firm. An essential characteristic of fixed assets is that they are reported at their book value and normally depreciate with time. Accounts ReceivableAccounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment.