Contents:

He oversees editorial coverage of banking, investing, the economy and all things money. They are helpful, friendly and have advisors available to answer questions and show you the way. Unlike some other brokers, users must navigate an automated menu when calling support. While testing the quality of customer service at Tastyworks, it was a pleasant surprise to receive replies from Nick Battista, better known as the co-host of the Bat vs. Bat show on the Tastytrade network.

When you’re ready to take a deeper dive beyond the “story,” Merrill has an extensive selection of Bank of America Securities and third-party research at the ready. Simply opening and funding an investment account at an online broker will allow you to get started investing. Through that account, you can begin to purchase investments and make trades on the stock market. Robinhood provides free stock, options, ETF and cryptocurrency trades, and its account minimum is $0, too. Mutual funds and bonds aren’t offered, and only taxable investment accounts are available.

Importantly, Fidelity offers $0 commissions for online stock and ETF trades, plus a high-quality mobile app that’s good for both beginners and seasoned investors. Check out the options the broker offers for funding your brokerage account. While most trading platforms let you fund your account by linking a checking or savings account, there are a few that allow you to use alternate methods, such as a debit or credit card and digital wallets. The best online brokers also offer various research tools you can use to evaluate stocks and market activity in real time. For instance, many investing platforms have built in stock screeners that allow you to find securities based on preferences like market capitalization, earnings per share or expense ratio. We also include a side-by-side comparison between the advantages and disadvantages of self-managed trading platforms and robo advisors.

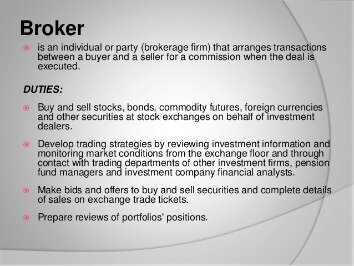

What is an online brokerage account?

An online brokerage account is a portfolio of cash and securities on an online trading platform. Investors can use online brokers instead of conventional financial advisors to buy and sell stocks, bonds, mutual funds, ETFs, options and other assets. New investors look for brokerage platforms that have tools and resources to help guide their investing journey. The best online brokers for beginners are easy to navigate, have strong educational features, provide excellent customer service, and offer a range of portfolio construction options. Some trading platforms for beginners also have low minimum balance requirements and offer demo versions to help get started.

Best Futures Trading Platforms of 2023 – Investopedia

Best Futures Trading Platforms of 2023.

Posted: Tue, 28 Mar 2023 14:57:34 GMT [source]

The site should use aggressive SSL encryption software, and ideally provide features like two-factor authentication during the sign-in process. As a long-time FOREX trader I was quickly captured by the attraction of the crypto-world. Besides my fascination for trading, it has always been essential for me to understand the underlying technology and ideology.

How to read stock charts: Learn the basics

Though Vanguard doesn’t have a minimum amount requirement to open an account, there are minimum investment requirements for some accounts. For instance, Vanguard Target Retirement Funds require a minimum of $1,000, whereas most actively managed funds have a $3,000 minimum. Public.com lets you invest in stocks, ETFs, and crypto with any amount of money. Share insights in a community and access a wealth of educational content.

Paired with low fees, outstanding customer service, and robust education resources, it’s clear how TD Ameritrade resonates with beginner investors. New product enhancements are continually rolled out as well, including updates to charting functionality and a portfolio digest feature announced in 2022. TD Ameritrade also stands out for its intuitive and dynamic portfolio tools. Navigation between mobile, desktop, and web versions is seamless and provides consistent experiences.

How do beginners trade stocks?

Another potential concern is that SoFi is a relatively new player in the https://trading-market.org/ industry, and it doesn’t have the same level of brand recognition or reputation as some of the more established firms. Optimized trade execution and higher interest on cash balances with IBKR Pro. We’ll note that Fidelity Youth Account isn’t a prepaid card nor a banking app, but it’s still strongly worth considering. Plynk™ lets you redeem unused gift cards for money that you can use to invest in your favorite companies. Open a Fidelity® Youth Account for your teen, and Fidelity will drop $50 into their account. Get $100 for yourself when you open a new Fidelity account and fund with $50¹.

An average of 85% of orders are executed at a better price than the National Best Bid and Offer , with an average execution speed of 0.07 seconds. The thinkorswim mobile app allows you to trade stocks, options, futures and forex. All of your settings and preferences from the thinkorswim desktop platform can be accessed on the mobile app.

- And $0 commission typically applies to stock and ETF trades; some brokers charge commissions for trading options and mutual funds, among other products.

- To switch this monthly fee for a 0.25% annual fee, like Wealthfront does, you have to set up recurring monthly deposits of $250 or reach a $20,000 balance across all your Betterment accounts.

- To start investing, you really don’t need to know much about the stock market.

- And by that we mean taking a thoughtful and disciplined approach to investing your money for the long-term.

- Javier is a personal finance reporter covering retirement, investing, crypto and more.

News and insights via live streaming video from the TD Ameritrade Network and CNBC are available via mobile. The app even has chat rooms built into it, so you can talk trading with your peers. TD Ameritrade also provides news and third-party research from Thomson Reuters, Dow Jones and Credit Suisse. Clients can receive a dose of daily inspiration from the firm’s Market Java email. Sent out before the market opens, it provides updates on pre-market conditions, major stock moves and analyst insights. How to choose the best broker for you can help you sort through the features brokerage firms offer and rank your priorities.

Stay away from these unless you see a real opportunity and do your research. Stay informed about selected companies, their stocks and the general market. Best Online Stock Trading For Beginners – Day trading is the act of buying and selling financial instruments multiple times on the same day or even within a single day. Taking advantage of small price swings can be a profitable game if done correctly. However, it can be dangerous for beginners and anyone who does not follow a well-thought-out strategy.

The best online brokers for beginners selection table is followed by a more detailed online stock trading review of each of these selected stock brokerages. If you are only trading stocks and just starting out, the $0 minimum balance to open an account will be very appealing. Compensation may impact which cards we review and write about and how and where products appear on this site . There is no longer a real minimum to start investing in the financial markets. With many brokers offering accounts with no required minimums and access to fractional shares, you can start investing with any amount of money.

Instead, you answer some basic questions about yourself and investment goals when signing up. Based on your answers, Betterment will then provide investing advice and recommendations based on the goal details you provided. I have all my accounts at Fidelity and have been happy with the decision. 401k, IRA, HSA, brokerage, checking , credit card (flat 2% cash back). Another important thing to consider is the distinction betweeninvesting and trading.

Top 7 Best Investment Apps For Beginners 2023 – Biz Report

Top 7 Best Investment Apps For Beginners 2023.

Posted: Sun, 26 Mar 2023 03:48:25 GMT [source]

Investing in equities and other assets can be intimidating when you start out, but a user-friendly broker will remove the fear factor by providing clear instructions to walk you through the trading process. The site should benefit from a clean design, helpful shortcuts and an effective search function. You should be able to buy and sell shares with minimal fuss, and you should then be able to manage your portfolio and check its performance with ease.

The three most common types of orders are market orders, limit orders and stop-loss orders. Most brokerages allow customers to trade online as opposed to phoning a trader on the floor of the stock exchange. Although some trading platforms may operate exclusively online, a few pair online trading with traditional financial advisers who offer help and advice. There are $0 fees for online U.S. stocks, exchange-traded funds and options trades, making it easy for new investors to start building their portfolios. There are also managed portfolios with a flat 0.30% annual management fee for those who may need more guidance.

From there, M1 can automatically rebalance your portfolio for you, or you can go in and manually change how small and large each Pie slice is. If you really want to put it on autopilot, you can invest in M1’s Expert Pies—professionally pre-built portfolios designed for different investment goals. (And if you want something in the middle, you can even combine Expert Pies with your own custom choices.) One downside of this robo-advisor is the lack of tax-loss harvesting functionality. In other words, you won’t be able to harvest losses outside of your retirement accounts to offset your tax bill come tax season. They can invest in stocks for as little as $1 with fractional shares.

The best brokerage accounts for beginners are those that feature educational tools, low account fees, and intuitive mobile platforms. Overall, Merrill Edge is a good choice for investors who want to manage their finances under one roof and have access to real-live financial advisors. The platform’s research and educational resources, user-friendly trading platform, and mobile app make it a good choice for both beginner and experienced investors. However, investors who are primarily interested in trading mutual funds or who are looking for lower fees may want to consider other platforms. Overall, SoFi Active Investing is a good option for investors who are looking for a commission-free brokerage platform with a wide range of investment options and other financial products and services.